Table of Contents

Disclaimer: The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice. Before making any investment decisions, consider consulting with a licensed financial advisor, tax professional, or other qualified expert.

Investing and Trading

The stock market can feel overwhelming for newcomers—complex terminology, volatile prices, a dizzying array of investment options, and the ever-present risk of loss can create uncertainty. Yet, for many people, building a well-structured investment portfolio is a key step toward achieving long-term financial security. Understanding core principles, following best practices, and using reputable resources can help you navigate this journey with greater confidence.

This guide provides a broad foundation, from explaining how the stock market works to introducing risk management, diversification, psychological discipline, and the importance of due diligence. By leveraging this information and continuously educating yourself, you can make more informed decisions to grow and protect your wealth.

How the Stock Market Works

What Is the Stock Market?

At its core, the stock market is a marketplace where shares of publicly traded companies are bought and sold. When a company goes public through an Initial Public Offering (IPO), it issues shares that investors can purchase, thus gaining part-ownership of the business. Over time, as a company grows and earns profits, its share price may increase, allowing shareholders to sell at a profit. Conversely, if a company struggles, its share price may decline.

A Brief History and Regulation

The modern U.S. stock market traces its origins to the Buttonwood Agreement of 1792, which led to the creation of the New York Stock Exchange (NYSE). Today, major exchanges like the NYSE and NASDAQ operate under regulatory oversight from organizations such as the U.S. Securities and Exchange Commission (SEC) to maintain fairness, transparency, and investor protections.

Supply and Demand Dynamics

Stock prices fluctuate based on supply and demand. When more people want to buy a stock than sell it, its price tends to rise. Conversely, if more people want to sell than buy, the price typically falls. Corporate performance, economic conditions, market sentiment, and global events all influence these supply-demand dynamics.

Types of Stocks and Investment Vehicles

Common and Preferred Stocks

- Common Stocks: Represent ownership in a company, often with voting rights. Potential returns come from share price increases and dividends.

- Preferred Stocks: Generally offer fixed dividends and have priority over common stocks in asset claims. They usually lack voting rights but can provide more predictable income.

Blue-Chip, Growth, and Value Stocks

- Blue-Chip Stocks: Shares of large, stable, well-established companies (e.g., Coca-Cola, Johnson & Johnson). They often pay steady dividends and offer relatively lower volatility.

- Growth Stocks: Companies expected to grow faster than the market average. They often reinvest profits to fuel expansion rather than pay large dividends, potentially offering higher returns at higher risk.

- Value Stocks: Stocks trading below what investors believe to be their intrinsic value. They may offer long-term appreciation if the market “catches up” with their underlying worth.

Dividend and Penny Stocks

- Dividend Stocks: Pay regular dividends, appealing to investors seeking income. Often mature, stable firms.

- Penny Stocks: Low-priced shares of small or distressed companies. They carry high risk due to limited liquidity, poor transparency, and higher volatility.

Funds: ETFs, Mutual Funds, Index Funds

- ETFs (Exchange-Traded Funds): Baskets of stocks (or other assets) that trade like single stocks. They offer diversification and can target specific sectors or market segments.

- Mutual Funds: Professionally managed collections of stocks, bonds, or other assets. Can be useful for beginners desiring instant diversification. Pay attention to fees and expenses.

- Index Funds: Passively managed funds designed to track a market index (e.g., S&P 500). They often have lower fees and historically competitive long-term returns.

References for Further Reading:

- U.S. SEC Investor.gov – Educational resources on stocks, funds, and diversification.

- FINRA’s Fund Analyzer – Helps evaluate mutual fund fees and expenses.

Foundational Steps Before Investing

1. Build an Emergency Fund

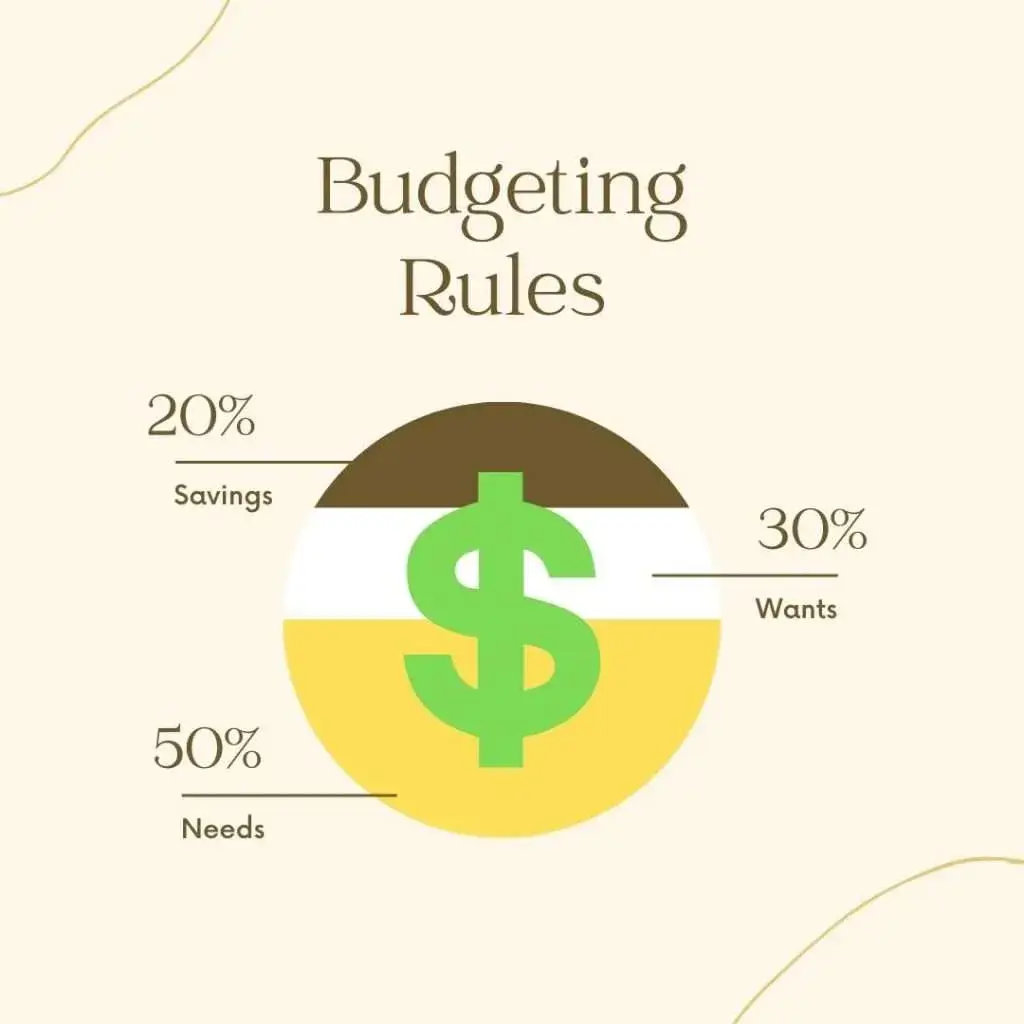

Before committing money to the stock market, secure a financial safety net. Most experts recommend setting aside three to six months of living expenses in a liquid, low-risk account. This cushion helps ensure you won’t be forced to sell investments at a loss during financial emergencies.

2. Assess Your Risk Tolerance and Capacity

- Risk Tolerance: How comfortable are you with fluctuating account values? Can you sleep soundly when the market dips?

- Risk Capacity: How much money can you afford to lose without derailing your financial goals?

Understanding both aspects is crucial. Tools available on Investor.gov or through reputable brokerage platforms can help you gauge your comfort with risk.

3. Define Clear Investment Goals

Clarify your objectives: Are you investing for long-term growth (e.g., retirement), medium-term goals (e.g., a home purchase in 10 years), or short-term gains (e.g., capitalizing on market swings)? The clearer your goals, the easier it is to select suitable investments and strategies.

Setting Up Your Investment Platform

Opening a Brokerage Account

Choose a reputable brokerage that aligns with your needs. Consider fees, account minimums, available research tools, customer service, and user-friendliness. Popular options in the U.S. include Fidelity, Charles Schwab, TD Ameritrade, and Vanguard. Always verify the credibility of brokers through FINRA’s BrokerCheck tool.

Tax-Advantaged Accounts

If available, consider tax-advantaged accounts like 401(k)s or IRAs. These can offer significant long-term tax benefits. For more information, visit the IRS website or consult a tax professional.

Building and Maintaining Your Portfolio

Asset Allocation and Diversification

- Asset Allocation: Distribute your investments across different asset classes—stocks, bonds, real estate, and cash—to balance risk and return. Younger investors might lean toward more stocks for growth, while those nearing retirement might prefer greater bond exposure for stability.

- Diversification: Avoid putting all your money into a single stock or sector. Using index funds or ETFs can instantly diversify your portfolio and reduce the impact of a single investment’s poor performance.

Fundamental Analysis

Before buying individual stocks, learn to read company financials, industry reports, and analyst research. Study key indicators like the price-to-earnings ratio (P/E), profit margins, debt levels, and growth rates. The SEC’s EDGAR Database provides company filings (e.g., 10-Ks, 10-Qs) to help you evaluate a firm’s fundamentals.

Technical Analysis (for Traders)

Traders often use charts, trends, and indicators (moving averages, relative strength index) to identify short-term trading opportunities. While technical analysis alone can’t guarantee success, it may help determine entry and exit points.

Rebalancing and Monitoring

Review your portfolio periodically—annually or semi-annually—to ensure it still reflects your target asset allocation and risk level. If one asset class outperforms and grows beyond your set parameters, consider selling some of it to buy others that have underperformed, maintaining your intended balance over time.

Investor Psychology and Behavioral Finance

Emotional Discipline

Avoid panic-selling during market downturns or chasing “hot” stocks due to fear of missing out (FOMO). Emotional decision-making can lead to suboptimal returns. Keep a long-term perspective and remember that market volatility is normal.

Long-Term Mindset

If you’re investing for retirement or other decades-long goals, short-term fluctuations matter less. Historical data shows that while markets cycle through booms and busts, they have generally trended upward over extended periods.

Trading vs. Investing

Differences in Approach

- Investing: Typically involves holding positions for years, focusing on fundamental company growth and long-term wealth accumulation.

- Trading: Involves shorter time horizons (days, weeks, months) and may rely more on technical analysis. Trading can be riskier and more time-intensive.

Risk Management for Traders

Traders should use strategies like stop-loss orders, position sizing, and strict trading plans to prevent small losses from becoming large ones. Continuous education and practice—potentially via paper trading or simulation—can help beginners hone their skills before risking real capital.

Taxes and Professional Guidance

Tax Considerations

Investment gains may be subject to capital gains taxes. Holding stocks for over a year often qualifies for lower long-term capital gains rates compared to short-term trades. Dividend income also has tax implications. Consult a tax professional or review IRS guidelines to understand how taxes affect your investment returns.

Professional Advice

For personalized guidance, especially as your portfolio grows, consider hiring a Certified Financial Planner (CFP) or Registered Investment Adviser (RIA). Use the SEC’s Investment Adviser Public Disclosure database or FINRA’s BrokerCheck to verify credentials and disciplinary histories.

Avoiding Scams and Unreliable Information

Red Flags

Beware of unsolicited stock tips, “guaranteed returns,” or pressure to invest in unfamiliar, obscure assets. These can be signs of fraud or pump-and-dump schemes.

Reliable Sources

Rely on reputable financial news outlets (e.g., The Wall Street Journal, Financial Times, Bloomberg) and official regulatory websites (e.g., SEC, FINRA) for accurate, up-to-date information. A strong foundation in research can help you filter out noise and hype.

Integrating Investing into Your Financial Life

Holistic Financial Planning

Investing is just one component of a robust financial strategy. Paying down high-interest debt, maintaining adequate insurance, and planning for major life events are equally important. Ensure that your investment approach complements your broader financial goals and circumstances.

Final Thoughts

Starting your investment journey can be challenging, but with proper planning, education, and resources, you can build a portfolio aligned with your objectives and comfort with risk. Prioritize diversification, conduct thorough research, and maintain emotional discipline. Over time, disciplined investing can help you create long-term wealth and secure your financial future.

For ongoing learning, explore resources at:

- Investor.gov by the SEC

- FINRA.org for regulatory guidance

- Morningstar for independent investment research

- UpFront Trading on how to read stock charts

Ultimately, the key is continuous learning, staying informed, and adjusting your strategy as your life goals and market conditions evolve.

AI Chatbot

AI ChatbotHi. How are you? How can we help you today?

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav