Table of Contents

Budgeting 101: Take Control of Your Finances

Feeling the pinch of inflation? You’re not alone. In today’s economic climate, making the most of your money is more important than ever. But with rising prices and competing demands, it can be easy to feel overwhelmed and unsure where your hard-earned cash goes.

This “Budgeting 101” guide is designed specifically for beginners and young adults ready to take charge of their finances. It provides a clear and actionable roadmap to creating a personalized budget that works for you.

Why Budget? The Power is in the Planning

Budgeting isn’t just about restricting yourself. It’s a powerful tool that empowers you to make informed financial decisions and achieve your long-term goals. Here are just a few reasons why budgeting is crucial for success:

- Gain Control: You must know exactly where your money goes. It helps you identify areas to cut back and free up funds for your priorities.

- Crush Debt: A well-defined budget allows you to allocate more money towards debt repayment, helping you become debt-free faster.

- Save for Your Dreams: Budgeting helps you prioritize savings goals, whether fors a down payment on a house, a dream vacation, or a secure retirement.

- Peace of Mind: Financial clarity reduces stress and anxiety, allowing you to enjoy life more.

Budgeting 101: The Building Blocks of a Budget

Before diving in, let’s explore the essential components of a strong budget:

- Income: Gather information on all your income sources, including salary, side hustles, or investments.

- Expenses: Track your spending for at least a month to understand where your money goes. Categorize expenses into fixed costs (rent, utilities) and variable costs (groceries, entertainment).

Popular Budgeting Methods:

There’s no one-size-fits-all approach. Here are two popular budgeting methods to consider:

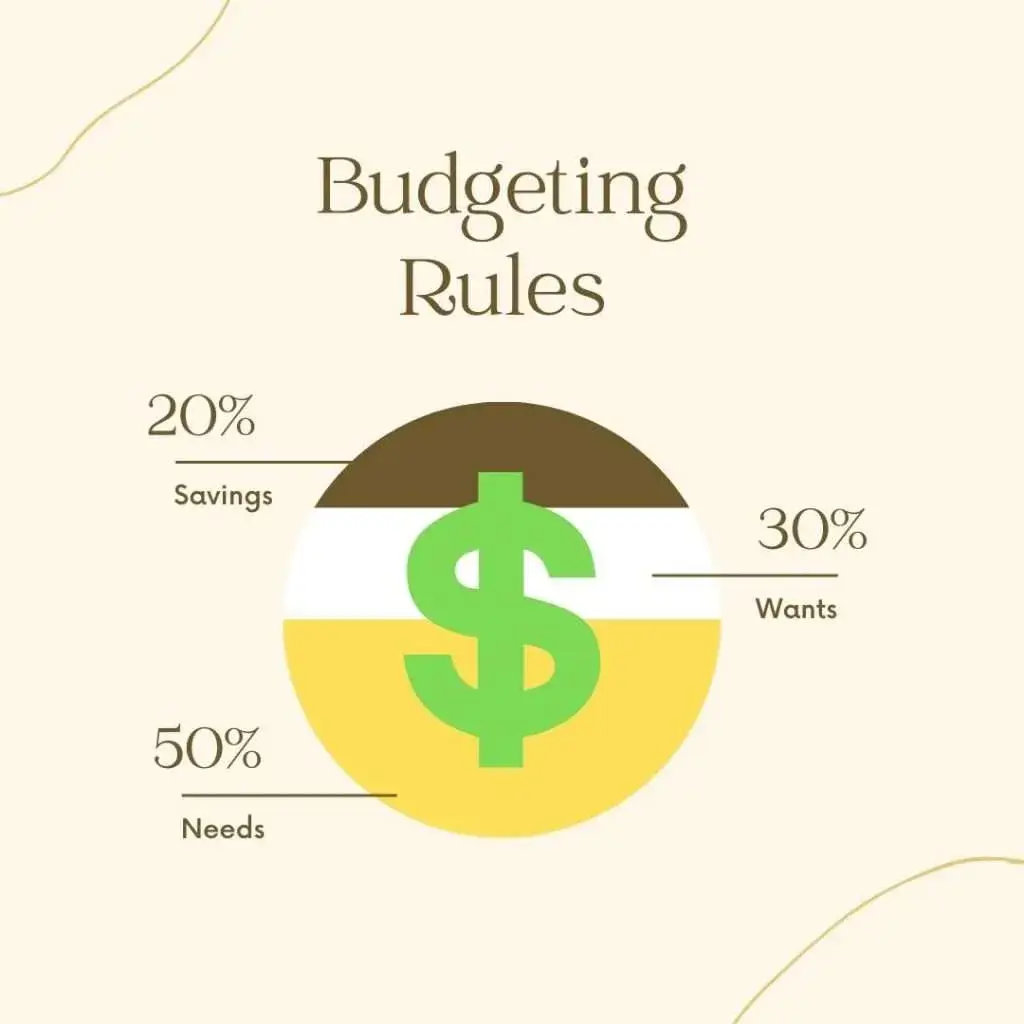

- 50/30/20 Rule: Allocate 50% of your income to needs (housing, food), 30% to wants (entertainment), and 20% to savings and debt repayment.

- Zero-Based Budgeting: Assign every dollar of your income a specific purpose, ensuring your income minus expenses equals zero.

Creating Your Personalized Budget

Now, let’s get down to business! Here’s a step-by-step guide to creating your personal budget:

- Gather Your Information: Collect bank statements, pay stubs, and receipts to track your income and spending habits.

- Choose Your Budgeting Method: You must select the method that best suits your personality and financial goals.

- Categorize Your Expenses: Create expense categories like housing, utilities, groceries, transportation, entertainment, debt payments, and savings.

- Track Your Spending: Utilize budgeting apps, like Quicken, Excel spreadsheets, or a simple notebook to record your daily expenses. Many banks offer free budgeting tools as well.

- Set Realistic Goals: You should start with achievable savings or debt repayment goals to build momentum and avoid discouragement.

- Automate Your Finances (Optional): Set up automatic transfers to savings and bill payments to streamline budgeting and avoid missed payments.

Budgeting Tools and Resources

- Budget Templates: Utilize free downloadable or printable budget templates available online.

- Budgeting Apps: Explore budgeting apps like Mint or You Need a Budget (YNAB) for easy expense tracking and goal setting.

Sticking to Your Budget: Challenges and Solutions:

Life throws curveballs – unexpected expenses can derail your best-laid plans. Here’s how to overcome common budgeting challenges:

- Unplanned Expenses: Build a buffer in your budget for emergencies or unexpected costs.

- Temptation to Overspend: Identify your spending triggers and create strategies to avoid them. Allocate a small “cheat day” budget with limitations to avoid feeling deprived.

Embrace the Journey: Budgeting is a Continuous Process

Remember, budgeting is a journey, not a destination. There will be adjustments along the way. Review your budget regularly, adjust as needed, and celebrate your milestones!

Ready to Take Control?

Budgeting empowers you to make informed financial decisions and achieve your financial goals. Follow the steps outlined in this guide, you can take charge of your finances and build a secure future. Upfront Trading offers a variety of resources and educational materials to help you on your financial journey. You should review our website or contact us to learn more about personalized financial guidance and investment strategies.